What to think about US wage growth?

US wage data are all over the place, with some indicators pointing to moderation and others continue to show pressure of labour shortages. We believe the tightness in the labour market will prevent wages from capitulating and expect them to continue to feed core inflation going ahead.

Doubts on the moderation of US wage growth

US unit labour costs in the private sector increased by 2.4% in Q3 2022 (below market forecasts of 3.1%), fostering the financial market rally early December. Nevertheless, the moderation in wage growth comes as the labour market remains tight, leading us to doubt the significant change in trend in wage growth. The jobs report’s monthly hourly earnings data began to rise again in November (0.6% over the month, after 0.5% in October, double the market consensus of 0.3%). On an annual basis, hourly earnings are up 5.1. According to the Atlanta Fed data, Americans that switch jobs are the main drivers in nominal wage growth (with wage growth up 7.7% YoY vs. 5.5% for job stayers).

Wage growth sustained by labour market tightness

The growth in wages, which can display inertia, depends on:

- long run inflation expectations (capturing forward looking wage setting behaviour);

- past inflation (allowing for potential backward indexation);

- and labour market slack (the difference between the current unemployment rate and the non-cyclical or natural rate of unemployment).

These inflation-linked determinants of wages are beginning to ease, but from high levels (Chart 1).

Chart 1: annual inflation realised vs. expected (%, YoY)

Labour market slack remains tight: the current unemployment rate being at 3.7% in November 2022, up from 3.5% in September, but still well below the natural rate of unemployment (4.4% according to the Congressional Budget Office’s estimate), also known as the NAIRU (Non Accelerating Inflation Rate Unit). The trend in new weekly jobless claims, measured by the four-week moving average, has risen to a three-month high of 230 thousand, after bottoming at 206K in early October. The trend is rising, but not surging.

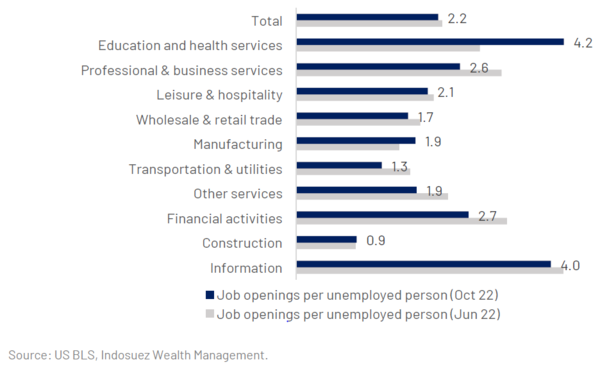

The degree of tightness in the labour market can also be measured by the gap between labour supply and labour demand. The number of unemployed has increased by 4% in November, while the number of October job openings has decreased by 8%. However, this still represents a ratio of 2.2 job openings to 1 unemployed person (Chart 2), compared to 1.45 on average in 2019. Labour shortages (or the gap between job openings and available unemployed persons) in the services sector have not improved in Leisure and Hospitality and have even increased in the Education and Health services sector (to an over 4 to 1 ratio). Lastly, it has significantly increased in manufacturing.

Chart 2: number of job openings to unemployed (ratio)

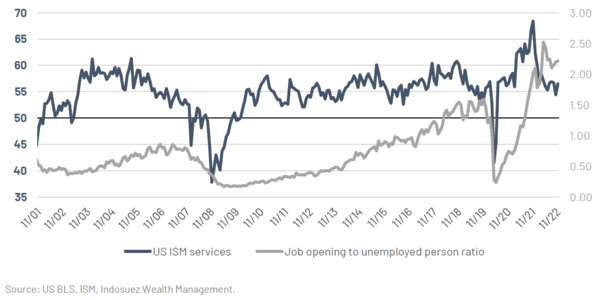

The degree of labour market tightness is significantly higher than the current economic situation justifies (Chart 3), owing to the impact of the pandemic on certain sectors that is taking time to dissipate. The pandemic also accelerated the already existing impact of the retirement of the baby boom generation, adding to labour shortages.

In conclusion:

- Due to these more structural issues, we expect wages to take time to react to the slowdown in activity and the labour market.

- Real wages (adjusted from inflation) could even improve as headline inflation dissipates in the coming quarters, an upside for the resilience in consumer spending in this challenging higher interest rate environment.

- Inertia in core inflation (excluding food and energy prices) will be longer than expected leading to probable renewed pressure on inflation in H2 2023.

Chart 3: job openings to unemployed ratio vs. level of services activity (ISM survey in points)

Key investor takeaways

- Markets were relieved to see November’s employment cost index as it added to their "wishful thinking" that inflation will moderate and the Fed will therefore shortly pivot to an accommodative policy. This is not our reading as we expect inflation, more specifically core inflation, to remain sticky as projected by consumer surveys. The Fed is not expected to U-turn as fast as markets may anticipate/hope, with a plateau of higher central bank rates for longer.

- This additional 50 basis point Fed rate hike expected on 15 December should drive short-term maturities up and push long-term interest rates down, but less given that monetary tightening is beginning to decelerate. The still inflationary context remains favourable to bond investments in the beginning of 2023 compared to equities.

December 13, 2022