US inflation: defying gravity

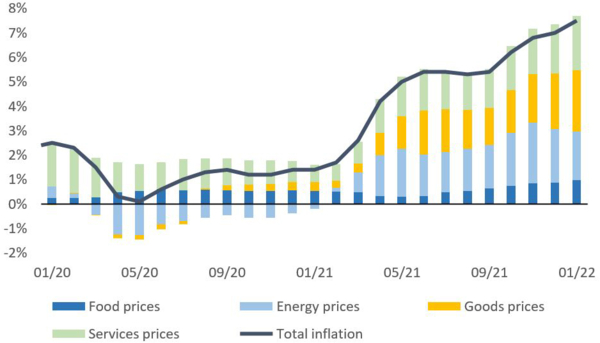

What goes up, must come down…but not yet for US inflation. January figures surprised yet again to the upside (+7.5% annual rate vs. the market forecast of 7.3%). Temporary factors explain a part of the rise in prices, but inflationary pressures are broad-based and the Fed’s first rate hike in March inevitable.

The facts

- US consumer price inflation accelerated to a monthly rate of 0.6% in January and to an annual rate of 7.5% (consensus market forecast 7.3%). The US Bureau of Labor Statistics underlined it was the highest annual rate since 1982.

- Energy prices continue to contribute heavily, but this time mostly due to a rise in electricity prices (up 4.2% over the month), most likely due to harsher weather conditions. Gasoline prices are still up 40% over the year, but surprisingly decelerated over the month of January despite the oil price surge.

- Food prices also contributed positively to inflation, with prices of food at home increasing 1.2% over the month and food away from home 0.7%. This can be explained by the increase in some agricultural commodity prices (soya, corn) and by the pass-through effect of higher wages in the take-out sector.

- Core inflation excluding the volatile energy and food components registered in at 0.7% over the month (+6% on an annual basis), also at historical highs. This was mainly due to an increase in the non-energy transportation prices (up 1% over the month and 24% over the year) as supply bottlenecks continue to drastically prop up vehicle prices, contributing to close to a quarter of the increase in total prices in January. The annual reweighting of the consumer price index slightly influenced these figures, as it trimmed the weight of the services component in favor of goods prices.

- On the services side, shelter prices – that make up a hefty 33% of the basket of goods on which inflation is calculated – increased by 0.4% over the month and 4% over the year. Increases in shelter prices take into account the COVID-19 inspired exodus from large cities that has caused rents to increase across the US. Furthermore, the lifting of the eviction moratoriums put in place at the height of the pandemic has allowed landlords to replace tenants with increased rents. Finally, prices of medical care services also increased by 1% over the month.

Outlook ahead

This was a very broad-based increase in US prices in January. Temporary increases in energy prices and supply-chain impacts are taking longer than expected to fade. Looking forward, the tightness of the labor market in certain sectors is putting upward pressure on hourly average earnings (up 5.7% on a yearly basis in January, the highest rate in 15 years) and increasing the risk of durable inflation. Furthermore, with the prospect of interest rates increasing, the demand for housing will most likely accelerate and continue putting upward pressure on shelter prices in 2022. All this being said, from a technical standpoint, year-on-year inflation figures should remain high, but moderate by the end of spring 2022 as monthly increases in spring 2021 were already very high. The risk factor is a full blown Ukrainian conflict which would lead to excessive energy prices.

Bottom line: in this context, markets have now factored in six to seven interest rate hikes in 2022.

Graph 1: US annual inflation by contributing component

Source: Bloomberg, Indosuez Wealth Management.

Edited as per 11/02/2022

February 14, 2022